Trump talks a lot about making American great again by using tariffs to move manufacturing back to our shores. Many experts say those tariffs will not do what he says they’re going to do and they’ll only end up costing you and I more money. And if by some chance they do result in some manufacturing moving back to the US, it will take many years for companies to adjust. Let’s break it down.

Tariffs aren’t sufficient

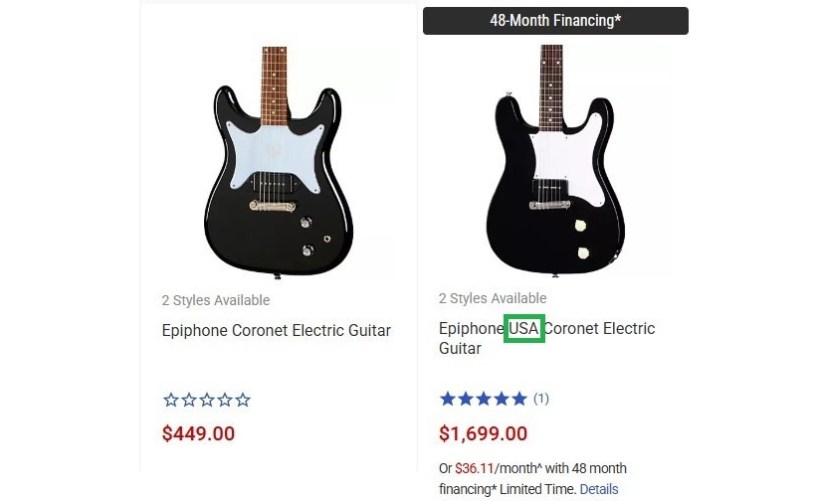

It is commonly claimed that the use of tariffs will “bring manufacturing back to the USA.” Will that actually work? No. The image above for this article shows two guitars. Now guitars are unique because musical instrument companies have been offering both US-made and foreign made models for a long time. There is a perceived higher value to the US-made models even though they’re being built using the same CNC technology. You’ll notice in the case above the foreign made guitar is about 1/4 the price of the American made one. A tariff of 10% or even 25% won’t tilt the scales in favor of the US-made product at all. You would need more on the order of a 400% tariff before even approaching equity. So all the 25% tariff is going to do is to cause that the $450 guitar to cost about $562. Yay. You get to pay an extra $112 and all that money just goes to the government.

Here’s another manufacturer. The American-made version only costs twice as much. Still nothing that will be affected by a 25% tariff. Oh, and chances are the “American made” versions will cost even more than they do now because they use foreign-sourced parts.

It’s just a tax

Since you pay it the overage and the government gets it, it’s really just a tax.

Great, so now we’ll get more services from the government, right? Nope. In fact those services are being eliminated as we speak. Lower tax bills? Also no, unless you’re really wealthy.

It’s a tax without representation

That’s what we had the Boston Tea Party about. Since normally there is the proposition that your local state congresspeople represent your interests and control the purse strings, there’s at least some plausibility in the supposition that you’re “represented” while being taxed. However, since tariff taxes are imposed unilaterally by the president going around your regular path of “representation”, you’re paying a tax without your normal influence into the matter, however small that may be.

It’s a regressive tax

Progressive taxes work such that a well-off person who can afford to pay more will. And the person or family that’s just getting by will pay less tax. However tariffs are not a progressive tax or even a proportional tax, and are in fact are what’s known as a regressive tax. There’s no income variable in the equation. Everyone will pay more for the products and the same amount more. The shoes for you kid that used to cost $60 will now maybe cost $240 made in America and the family just getting by will either have to settle for an inferior product or pay that price. While the well-off family just shrugs and buys the $240 shoes.

Well actually, what will probably really happen: the foreign product will still be significantly cheaper but will be $75 instead of $60 so the less well-off family would just still buy foreign and pay $15 more. Heck, probably even the well-off family buys the foreign-made shoes. So ultimately we all likely buy foreign and pay more with that extra money going (regressively) to the government.

How fast will we start making everything here again?

We’ve already determined that a 25% tariff won’t even begin to cause it to make sense for a company to move manufacturing back. But suppose they do anyhow. Like the guitar makers, maybe people will really willingly pay 2x to 4x more for a TV set made in the US. *cough* Yeah right.

In any case, it will take years to build factories and rejigger supply chains to make product here. And if manufacturing moves back that will result in more demand for labor and therefore more competition for labor. And even higher prices.

In summary, be careful what you wish for.

The bottom line

Tariffs will hurt foreign countries and foreign workers. In the US we’ll pay more and we won’t get anything more in return. So what does the money do? I hate to sound like a broken record, but this income really apparently just goes to partially pay for more tax cuts for billionaires.

So if the experts say this is a bad idea and won’t work, why is it happening? The wealthy tend to do very well with market turbulence and even in down economic times. And we’ll leave it there.

*The screenshots of guitar prices are recent (early 2025) and from musiciansfriend.com, a popular music retailer.